A home loan pre-approval is highly recommended of these to shop for a house. Home loan pre-approval away from a lender gives consumers a sense of whatever they can be borrow hence and therefore features they are able to realistically manage. The home sector could be extremely aggressive, and you may an excellent pre-acceptance indicates to help you real estate professionals that you’re a serious contender once you find a home. It can then make sense one to a buyer with several pre-approvals create status themselves as the a level stronger contender. Absolutely a great amount of pre-approvals grows a buyer’s probability of in fact having one or more financial officially agree the app? As the need is actually voice, the exact opposite holds true.

Making an application for numerous pre-approvals does not alter your updates because the a buyer and you will indeed significantly less a borrower. Let’s evaluate how a great pre-approval application influences your credit score as well as how applying for multiple pre-approvals can in fact features a terrible impact on your credit report and you may score.

What is actually a credit history?

Your credit score is actually a number one to indicates to help you a lender the danger doing work in financing money to you personally. A credit history is founded on studies of your own private borrowing from the bank report which has:

A credit rating are submitted by the national credit rating bodies (CRBs). According to the credit scoring looks, your credit score is lots ranging from 0-one thousand otherwise 0-1200. A premier amount matches with a decent credit history and you may reasonable exposure to loan providers while you are a reduced count try indicative off an excellent less than perfect credit history which a top exposure so you’re able to loan providers. The financing rating matter was scaled towards among four categories complete with unhealthy, average, a good, pretty good and advanced level.

Who identifies my credit score?

Credit scoring authorities gather studies from creditors to help make the private credit file. What found in your credit score will then be regularly make your credit rating.

You should check your credit rating free of charge using lots away from on the internet business. It must be indexed there exists five other credit reporting government one work in Australian continent and a credit rating may vary according to and that credit scoring human anatomy has been used. For a precise image of your credit score you can check your credit score along with that vendor.

What https://paydayloansconnecticut.com/sherman/ are the benefits of checking your credit score?

Credit rating options aren’t infallible, and you will errors would can be found. Finding problems very early before it affect your debts are a major benefit of examining your credit score. If for example the rating looks unusually lower, you could potentially demand a duplicate of your own credit report and check that all facts is actually best. Guidance contained in your credit report tends to be wrong, out-of-date, unfinished or unimportant.

Should this be possible, you ought to contact the financing revealing agency to obtain the issue resolved. Given you have got proof, you are legally permitted have incorrect information altered.

If you discover mistakes on the credit report, such software to possess credit you failed to make, it may be that someone is utilizing your title to put on to possess credit. Which practice is rising and securing your self out of identity thieves is another reason to test your credit rating.

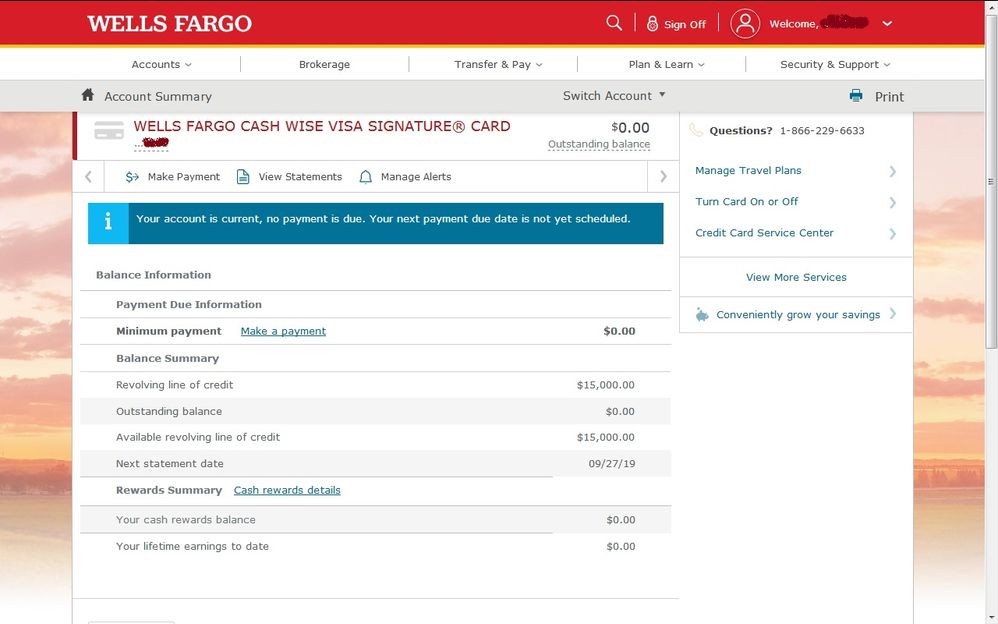

It can be advantageous to look at the credit history one which just complete a good pre-recognition application as it could build a distinction to your amount a loan provider was prepared to lend you. If you find which you have a reduced credit score, it is best if you hold off for the people pre-acceptance software. Instead, you ought to spend the go out enhancing your credit rating. Obtaining borrowing from the bank which have a higher credit rating could help safe a far greater interest and you can a far greater economic tool.