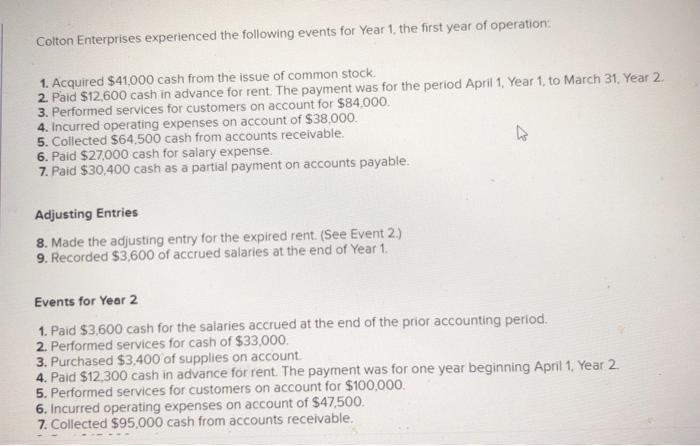

It’s really no magic that it is not instance cost effective to borrow funds today. At all, the Government Put aside has increased their benchmark rate eleven times over the past eighteen months – and while the new Fed opted not to walk costs within latest conference, its benchmark rates has been in the a beneficial 22-12 months higher . One to, in turn, provides was the cause of pricing getting many techniques from playing cards in order to mortgage loans so you can skyrocket.

There’s you to definitely possibly sensible solution to obtain immediately, though, which is of the making use of their house’s guarantee . Borrowing against your house equity might be a smart option whenever you want usage of loans, once the costs are usually lower than you can aquire with other types of loans. And you can, an average homeowner currently have in the $2 hundred,000 when you look at the tappable house security , and is a very important source of money for various monetary goals, if we need to fund renovations, pay off higher-desire expenses, spend money on a different business enterprise or defense unexpected expenses.

But are there family guarantee choices if you would like access to the fund rapidly – whenever very, which are the fastest ways to accomplish this? Before you decide for the a property security borrowing station, here is what you have to know.

Family guarantee personal line of credit

A house guarantee credit line (HELOC) try an adaptable and you can speedy solution to accessibility your home security. These types of house guarantee mortgage services eg a credit card, letting you borrow secured on the guarantee as soon as you you prefer financing.

The applying and you can recognition techniques for an effective HELOC normally generally become finished in a couple weeks, and when acknowledged, you have access to fund very quickly. HELOCs typically render straight down rates than other types of credit.

Since , the common HELOC speed was nine.09%, which is far lower than you’ll be added to many other types of finance right now, therefore it is a payment-energetic alternative.

Cash-aside refinancing

Cash-away refinancing pertains to replacement your current mortgage with a brand new you to definitely, in the a higher dominating harmony. The essential difference between the new and you will dated mortgage is paid for your requirements inside bucks. This technique also provide a lump sum payment out of loans, also it can be accomplished relatively quickly, based on your own lender’s results.

Having said that, it’s important to understand that you happen to be trading your existing real estate loan aside with a brand new you to definitely – and therefore, your own speed may differ. For many who bought otherwise refinanced your property when prices was in fact hanging near step three% from inside the 2020 and you can 2021, it may not be the best relocate to like this nowadays. After all, home loan costs are averaging better a lot more than 7% currently, so it is possible that their payment per month do improve significantly between the https://paydayloancolorado.net/trinidad/ eye charges to your family equity loan together with higher amount borrowed.

Family equity mortgage

Property collateral financing , called a moment home loan, allows you to acquire a lump sum payment with your home collateral because the equity. The new approval techniques often is reduced than other family-relevant financing types, and you can receive the finance promptly.

Rates of interest to the house collateral money also are normally fixed , making it simpler in order to plan for installment. And, now, house guarantee finance come with prices which might be much lower towards average than the a great many other particular financial loans. An average overall price getting a property security mortgage is 8.94% currently.

Opposite mortgage

Reverse mortgages is actually a financial device available to residents old 62 or earlier. Such finance will let you convert your home collateral on the income tax-totally free cash without the need to build month-to-month mortgage repayments.

This provide immediate access to help you fund to own retirees and you can seniors, however it is essential to very carefully comprehend the terms and conditions and you will ramifications before continuing. And you will, reverse mortgage loans might have an extended loan techniques compared to most other kind of household security loans, therefore ensure that this new schedule meets your needs should your objective should be to make use of the home’s guarantee right away.

Bridge loan

Bridge fund try small-label financing that will help access domestic collateral quickly whenever you’re in the procedure of promoting your existing household and buying a special you to definitely. He could be employed for covering the down payment in your the family before you could have the arises from the old residence’s revenue. Link loans normally have higher rates, very they truly are best utilized for quick-name means – nonetheless they is a great boost if you’re seeking utilize your house’s collateral to finance the purchase of good new home.

House guarantee sharing preparations

Equity-sharing agreements cover integrating with a trader which will give you cash in replace to own a portion of your own home’s future adore otherwise guarantee. This process allows you to supply your home guarantee in the place of running into loans.

However, although this alternative can be quick and could n’t need monthly installments, it is critical to see the potential a lot of time-identity financial implications of this kind regarding contract. You should also cautiously look at the words before generally making any choices.

The bottom line

Cashing your family guarantee can provide you with far-expected finance a variety of financial goals. However, it is imperative to buy the strategy one aligns better with your specific need and things. Just before tapping into your house equity, it’s a good idea to make sure you are making an informed choice hence you fully understand the ramifications of one’s chosen method.

Angelica Leicht are elderly editor to possess Dealing with Your bank account, in which she produces and you can edits stuff to the a selection of individual money subjects. Angelica previously held editing roles from the Simple Dollars, Appeal, HousingWire or other monetary e-books.