Chloe Moore, CFP, is the originator out-of Monetary Basics, an online, fee-only monetary think firm-based into the Atlanta, GA, and you will offering readers nationwide. Their own business is serious about assisting technology personnel inside their 30s and you can 40s that business-oriented, philanthropic, and goal-driven.

Lenders use credit scores determine creditworthiness. An excellent FICO rating away from 580 or less than sets a borrower within the the indegent borrowing from the bank class, exhibiting higher risk. not, which have a credit rating within variety does not mean you are entirely shut-out of getting that loan if you’d like you to.

You have certain choices if you’re looking to own loan providers that offer personal loans having a beneficial 550 credit score. Which is reassuring to know if you wish to borrow money to help you defense a monetary crisis otherwise need to get a little loan to repay so you’re able to reconstruct your credit history.

We explored different lenders to obtain of these you to definitely extend signature loans in order to borrowers having straight down credit scores. Know where you’ll get a personal bank loan which have a 550 credit score, what exactly is you’ll need for recognition, and you will alternative borrowing possibilities.

Finest unsecured loans getting 550 credit rating

We place about three ideal lenders and you can mortgage marketplace within the microscope so you’re able to decide which best suits your position.

Reputable Most readily useful areas

- Wide selection of loan providers

- Easier speed contrasting

- Easy software techniques

Legitimate stands out since a superior market for signature loans, even for consumers that have a great 550 credit rating. It allows users examine prices from additional lenders in a single platform.

Leveraging its comprehensive circle, possible consumers can submit one app and have now prequalified rates-the versus harming the credit rating through a difficult credit score assessment. This makes Credible the place to start people trying an effective personal loan.

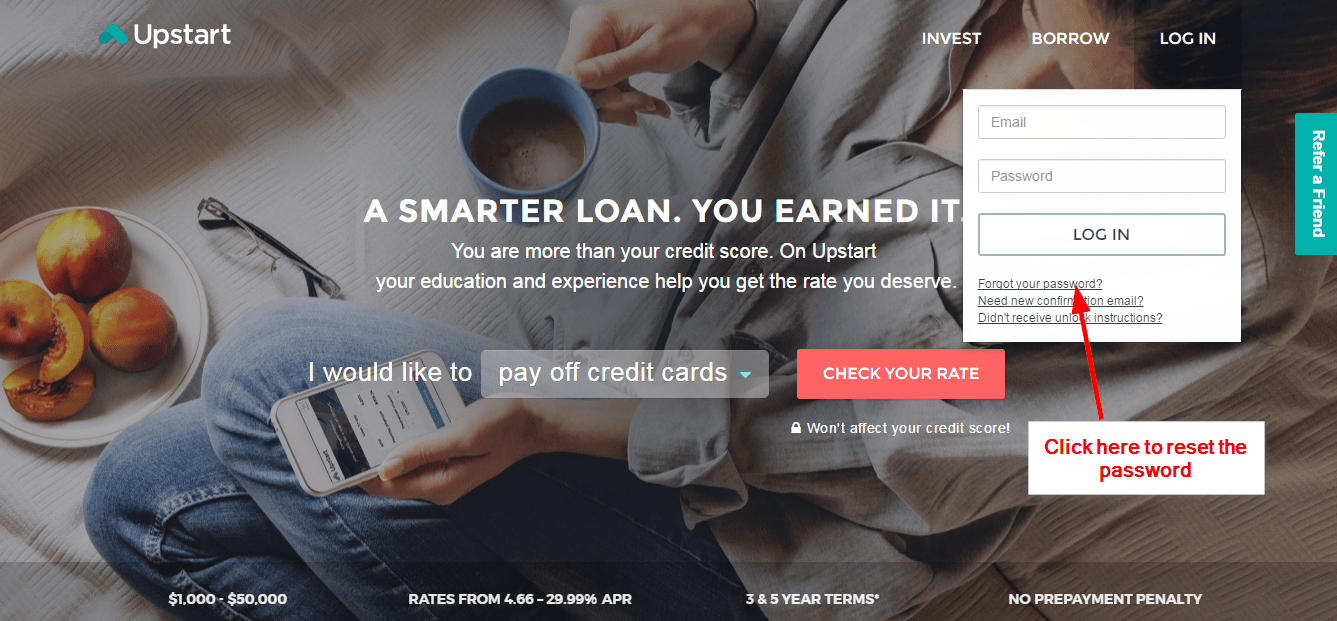

Upstart Ideal for absolutely nothing-to-zero credit

- Rates derive from studies and you may job record

- Quick behavior and next-date financial support

- No prepayment charges

Upstart is great getting helping individuals with virtually no credit records. In the place of relying entirely to the credit scores, Upstart considers informative history and you may job records when determining mortgage terms and you can rates.

This process could produce much more equitable payday loan Westover pricing to possess borrowers who’s become punished of the more traditional credit metrics. Combined with small decision times and next-big date resource, Upstart brings perfect for those people fresh to borrowing.

When you get personal loans having fico scores under 550?

Personal loans promote the means to access dollars when needed, however it is vital that you understand what you’ll get. That have a credit score regarding 550 or lower than can affect the newest mortgage terminology you can qualify for, including:

- How much cash you’re able to use

- Financing rates of interest and charges

- Fees terms

Comparing the benefits and you can downsides and you will what you want the cash to own can help you determine whether personal loans having a good 550 credit history sound right. Also, it is helpful to imagine some possibilities so you can personal loans when the you aren’t able to find an excellent financing choice.

Pros and cons out of unsecured loans if the credit score try 550

A great 550 credit score is not a complete burden so you can acceptance, since there are lenders you to extend fund having lowest (if any) minimum credit score requirements.

It could take just moments to apply for a beneficial personal bank loan on the internet and get approved, which includes loan providers providing financial support as fast as the next providers big date.

A credit rating regarding 550 otherwise lower than can result in a highest rate of interest towards loan or a more impressive origination percentage, should your bank fees one to.

You’re limited to getting an inferior mortgage, which is a disadvantage if you have more substantial monetary you need.